Insurance is a financial mechanism that provides protection against unforeseen events, offering individuals, businesses, and organizations a safety net to mitigate risks. By paying a premium, policyholders transfer the financial burden of potential losses to an insurance company, which compensates them in the event of a covered incident. Insurance plays a critical role in modern economies, promoting stability and security across personal and commercial domains. This article delves into the history, types, principles, benefits, challenges, and global impact of insurance, providing a complete overview of this essential industry.

What is Insurance?

Insurance is a contract, known as a policy, between an individual or entity (the policyholder) and an insurer. The policyholder pays a regular fee, called a premium, in exchange for the insurer’s promise to cover specified losses or damages caused by events like accidents, illnesses, natural disasters, or death. The insurer pools premiums from many policyholders to pay claims, operating on the principle of risk-sharing. Insurance can cover virtually any risk, from personal health to property damage, ensuring financial stability in uncertain times.

Key Components of Insurance

- Policyholder: The individual or entity purchasing the insurance.

- Insurer: The company providing the insurance coverage.

- Premium: The fee paid by the policyholder, typically monthly, quarterly, or annually.

- Policy: The contract detailing coverage, terms, and conditions.

- Claim: A request for compensation after a covered event.

- Deductible: The amount the policyholder must pay out-of-pocket before the insurer covers the rest.

- Coverage Limit: The maximum amount the insurer will pay for a claim.

History of Insurance

The concept of insurance dates back thousands of years. Ancient Babylonian merchants in 2000 BCE used a system called “bottomry,” where lenders would fund sea voyages and forgive the loan if the ship was lost, effectively insuring the cargo. In the 14th century, Italian merchants developed marine insurance to protect against losses at sea, formalizing contracts in Genoa by 1347. The first modern insurance company, Lloyd’s of London, emerged in the late 17th century, insuring ships and cargo at Edward Lloyd’s coffee house.

The Great Fire of London in 1666 spurred the development of fire insurance, with companies like the Insurance Office for Houses established in 1681. Life insurance gained traction in the 18th century, with the Amicable Society for a Perpetual Assurance Office founded in 1706. Over time, insurance evolved to cover diverse risks, from health to automobiles, driven by industrialization, urbanization, and regulatory frameworks. Today, the global insurance market is a multi-trillion-dollar industry, with companies like Allianz, AXA, and UnitedHealth Group leading the sector.

Principles of Insurance

Insurance operates on several fundamental principles:

- Utmost Good Faith (Uberrimae Fidei): Both the insurer and policyholder must disclose all relevant facts honestly. For example, a policyholder must report pre-existing medical conditions when applying for health insurance.

- Insurable Interest: The policyholder must have a financial stake in the insured item. For instance, you can insure your own car but not a stranger’s.

- Indemnity: Insurance aims to restore the policyholder to their pre-loss financial state, not to profit them (except in life insurance).

- Proximate Cause: The insurer only covers losses directly caused by the insured event. If a fire causes a building collapse, the fire is the proximate cause, and the claim is valid.

- Subrogation: After paying a claim, the insurer can pursue a third party responsible for the loss to recover the amount (e.g., suing a negligent driver in a car accident).

- Contribution: If multiple policies cover the same risk, each insurer pays a proportionate share of the claim.

- Loss Minimization: Policyholders must take reasonable steps to reduce losses after an incident, such as putting out a small fire to prevent further damage.

Types of Insurance

Insurance can be broadly categorized into several types, each addressing specific risks.

1. Life Insurance

Life insurance provides a payout to beneficiaries upon the policyholder’s death, ensuring financial support for dependents. It can also include savings or investment components.

- Term Life Insurance: Covers a specific period (e.g., 10 or 20 years). If the policyholder dies during the term, beneficiaries receive the payout. It’s affordable but has no cash value.

- Whole Life Insurance: Covers the policyholder for their entire life, with a savings component that builds cash value over time. Premiums are higher but fixed.

- Universal Life Insurance: Offers flexibility in premiums and death benefits, with an investment component tied to market performance.

- Endowment Plans: Combine life insurance with savings, paying a lump sum at the end of the term or upon death.

2. Health Insurance

Health insurance covers medical expenses, including hospitalization, surgeries, and medications. It can be provided by private companies, employers, or government programs (e.g., Medicare in the U.S.).

- Individual Health Insurance: Purchased directly by individuals, covering themselves and their families.

- Group Health Insurance: Offered by employers, covering employees and often their dependents at a lower cost.

- Critical Illness Insurance: Pays a lump sum upon diagnosis of specific illnesses like cancer or heart disease.

- Health Savings Accounts (HSAs): Paired with high-deductible plans, allowing tax-free savings for medical expenses.

3. Property Insurance

Property insurance protects physical assets against damage or loss.

- Homeowners Insurance: Covers homes and personal belongings against risks like fire, theft, and natural disasters. It also includes liability coverage for injuries on the property.

- Renters Insurance: Protects tenants’ belongings and provides liability coverage, but not the building itself.

- Flood Insurance: A separate policy for flood damage, often required in high-risk areas.

- Earthquake Insurance: Covers earthquake-related damages, typically excluded from standard homeowners policies.

4. Auto Insurance

Auto insurance is mandatory in many countries and covers vehicles against accidents, theft, and liability.

- Liability Insurance: Covers damages or injuries to others caused by the policyholder.

- Collision Insurance: Pays for damage to the policyholder’s vehicle in an accident.

- Comprehensive Insurance: Covers non-collision events like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for the policyholder and passengers, regardless of fault.

5. Business Insurance

Business insurance protects companies from financial losses due to operational risks.

- General Liability Insurance: Covers lawsuits for bodily injury, property damage, or advertising injury.

- Commercial Property Insurance: Protects business assets like buildings, equipment, and inventory.

- Workers’ Compensation Insurance: Covers employee injuries or illnesses related to work, often legally required.

- Cyber Insurance: Protects against data breaches, cyberattacks, and related liabilities.

6. Travel Insurance

Travel insurance covers risks associated with trips, such as cancellations, medical emergencies, or lost luggage.

- Trip Cancellation Insurance: Reimburses non-refundable expenses if a trip is canceled for covered reasons.

- Medical Travel Insurance: Covers emergency medical expenses abroad.

- Baggage Insurance: Compensates for lost, stolen, or damaged luggage.

7. Specialty Insurance

Specialty insurance covers unique risks not addressed by standard policies.

- Pet Insurance: Covers veterinary expenses for pets, including surgeries and medications.

- Event Insurance: Protects against cancellations or liabilities for events like weddings or concerts.

- Crop Insurance: Compensates farmers for losses due to weather, pests, or market fluctuations.

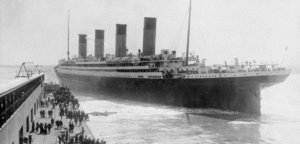

- Aviation and Marine Insurance: Covers aircraft, ships, and cargo against damages or losses.

Benefits of Insurance

Insurance offers numerous advantages for individuals, businesses, and society:

- Financial Security: Provides a safety net against unexpected expenses, such as medical bills or property repairs.

- Risk Management: Transfers the financial burden of risks to the insurer, allowing policyholders to plan with certainty.

- Peace of Mind: Reduces stress by ensuring support during crises, such as the death of a breadwinner.

- Economic Stability: Insurers invest premiums in financial markets, supporting economic growth.

- Encourages Savings: Policies like whole life insurance and endowment plans promote long-term savings.

- Legal Compliance: Meets mandatory requirements, such as auto insurance for drivers or workers’ compensation for employers.

- Social Benefits: Government-backed insurance programs, like unemployment insurance, reduce poverty and inequality.

Challenges in the Insurance Industry

Despite its benefits, the insurance industry faces several challenges:

- Rising Costs: Increasing healthcare costs, natural disasters, and cyber risks drive up premiums.

- Fraud: Insurance fraud, such as fake claims or staged accidents, costs the industry billions annually. In the U.S., fraud accounts for about 10% of property and casualty insurance losses, according to the Insurance Information Institute.

- Regulatory Complexity: Insurers must comply with diverse regulations across countries, complicating operations.

- Climate Change: More frequent and severe natural disasters, like hurricanes and wildfires, strain insurers’ reserves. For example, global insured losses from natural catastrophes reached $125 billion in 2023, per Swiss Re.

- Technological Disruption: Insurers must adapt to digital transformation, including AI, telematics, and blockchain, to remain competitive.

- Underinsurance: Many people, especially in developing countries, lack access to insurance. The global protection gap for natural disasters was $218 billion in 2023, according to Aon.

How Insurance Works

The insurance process involves several steps:

- Risk Assessment: The insurer evaluates the policyholder’s risk profile (e.g., age, health, driving record) to determine the premium.

- Premium Payment: The policyholder pays the premium, either as a lump sum or in installments.

- Policy Issuance: The insurer issues a policy document outlining coverage, exclusions, and terms.

- Claim Filing: If a covered event occurs, the policyholder files a claim with supporting evidence (e.g., medical bills, police reports).

- Claim Assessment: The insurer investigates the claim to verify its validity and calculate the payout.

- Payout: The insurer compensates the policyholder, minus any deductible, up to the coverage limit.

Global Insurance Market

The global insurance market was valued at approximately $6.5 trillion in 2024, according to Statista, with life and health insurance accounting for the largest share. The U.S. is the largest market, followed by China and Japan. Major players include:

- UnitedHealth Group (U.S.): A leader in health insurance, with 2024 revenues of $400 billion.

- Allianz (Germany): A top provider of property, casualty, and life insurance.

- China Life Insurance (China): The largest life insurer in Asia.

- AXA (France): Known for its global presence in life, health, and property insurance.

Emerging trends include the rise of insurtech (technology-driven insurance), parametric insurance (payouts based on predefined triggers like earthquake magnitude), and increased focus on sustainability, with insurers promoting green initiatives.

Insurance Regulations

Insurance is heavily regulated to protect consumers and ensure market stability. In the U.S., the National Association of Insurance Commissioners (NAIC) sets standards, while state regulators oversee compliance. Globally, organizations like the International Association of Insurance Supervisors (IAIS) promote cooperation. Key regulations include:

- Solvency Requirements: Insurers must maintain adequate reserves to pay claims (e.g., Solvency II in the EU).

- Consumer Protection: Laws ensure fair pricing, transparency, and prompt claim processing.

- Anti-Fraud Measures: Governments impose penalties for fraudulent claims or misrepresentation.

Choosing the Right Insurance

Selecting the right insurance involves several considerations:

- Assess Needs: Identify risks, such as health issues, property value, or business liabilities.

- Compare Policies: Look at coverage, premiums, deductibles, and exclusions across providers.

- Check Insurer Reputation: Research the insurer’s financial stability and customer reviews. Ratings from agencies like A.M. Best or S&P can help.

- Understand Exclusions: Policies often exclude certain events, like pre-existing conditions in health insurance or wear-and-tear in property insurance.

- Consult Experts: Insurance agents or brokers can provide personalized advice.

Future of Insurance

The insurance industry is evolving rapidly, driven by technology and changing consumer needs:

- Artificial Intelligence (AI): AI improves risk assessment, fraud detection, and customer service through chatbots and predictive analytics.

- Telematics: Usage-based auto insurance, like pay-per-mile plans, uses data from vehicle sensors to set premiums.

- Blockchain: Enhances transparency in claims processing and reduces fraud through secure, decentralized records.

- Climate Adaptation: Insurers are developing products to address climate risks, such as parametric insurance for floods.

- Personalization: Big data enables tailored policies based on individual behavior and preferences.

Conclusion

Insurance is a cornerstone of financial planning, offering protection and stability in an uncertain world. From life and health to property and business, insurance addresses a wide range of risks, benefiting individuals, businesses, and society at large. While challenges like fraud, climate change, and regulatory complexity persist, technological advancements are reshaping the industry, making it more efficient and accessible. Understanding the types, principles, and benefits of insurance empowers consumers to make informed decisions, ensuring they are prepared for life’s uncertainties.

For more information on insurance regulations and providers in your region, consult local government resources or visit the websites of major insurers the NAIC (https://www.naic.org).

Leave a Reply